Chapter 5

Test Impairment and Dispose

Impairment testing of assets is an important process in any organization for several different reasons. Financial statements should provide, as close as prudently possible, the most accurate and up to date information about the company to investors and other users of those financial statements so that they can make informed and educated decisions.

It is also important from a management standpoint to know that the company’s reported financial position and performance indicators are accurate.

Non-financial assets will typically hold significant value in a company and if their value is not accurately represented, it could materially influence financial statements and performance ratios, leading to a false impression of a company’s overall position which is dangerous waters to be in.

Conducting impairment tests and making sure an asset’s carrying value is in line with its true market value will mitigate these risks.

Impairment testing under IFRS vs GAAP

GAAP Impairment

IFRS Impairment

An impairment of an asset occurs when the carrying amount (or cash-generating unit/asset group) exceeds its recoverable amount (the true value in the market).

Under IFRS, companies are required to test fixed assets for impairment when indicators of impairment exist, while goodwill and other intangible assets should be tested at least annually.

At each reporting date, an organization is required to determine whether any indicators of impairment are present. Indicators can come from external sources, such as the economic and market environments, changes in interest rates, significant changes in relevant technology, etc., and internal sources, such as restructurings, visible physical damage to assets, etc.

While under IFRS, companies are required to assess whether possible impairment has occurred by monitoring the impairment indicators, under GAAP, companies are advised to do an impairment test ONLY when they are certain that an assets carrying value cannot permanently be recovered.

The two different impairment testing methods

Impairment testing under IFRS is a one-step process with various calculations, while under GAAP, a two-step process is required.

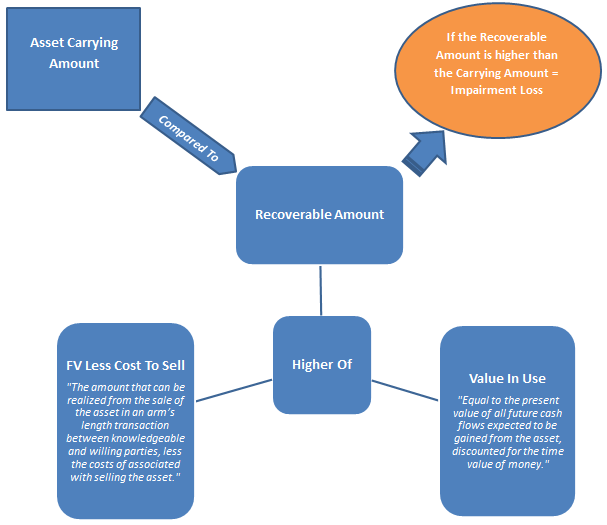

IFRS states that to measure impairment, an asset’s carrying amount has to be compared to its recoverable amount. The asset’s recoverable amount is the higher of:

- its fair value less the costs a company would have to incur to sell it (cost to sell) or ;

- the asset’s value in use.

Fair value less costs to sell (FVLCS) is the amount that can be realized from the sale of the asset in an arm’s length transaction between knowledgeable and willing parties, less the costs associated with selling the asset.

The value in use of an asset is equal to the present value of all future cash flows expected to be gained from the asset, discounted for the time value of money.

If the recoverable amount is higher than the carrying amount, an impairment loss has to be recognized.

The two-step process under GAAP starts with a recoverability test, where the sum of the undiscounted future cash flows is compared to the carrying amount of the asset. If the carrying amount is bigger than the sum of the future cash flows, then the asset is deemed to be not recoverable.

Only when the asset is classified as not recoverable, then the impairment loss is calculated.

The impairment loss under GAAP is calculated by taking the asset’s current carrying amount and deducting the fair value (which is the same as the sum of the undiscounted future cash flows calculated in Step 1).

Determining the Fair value of fixed assets under IFRS

Under IFRS 13, an assets fair value is defined as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.”

It’s a broad standard and can be fairly subjective when it comes to determining the fair value of a fixed asset. Therefore, IFRS includes numerous considerations to help guide management to come to the most accurate market fair value. These considerations include:

- The condition, location and any restrictions on the sale of the asset.

- The most advantageous market in which an orderly transaction would take place for the asset.

- The highest and best use of the asset, including whether or not the asset has to be used in combination with other assets or can it function on its own (stand-alone basis).

- Similar assumptions that other market participants would use when pricing the asset.

Determining the fair value can be a complex process. As such, IFRS 13 further includes a hierarchy of methods to follow when assessing which inputs are available to management when calculating the fair value. Where possible, Level 1 is the preferred method:

- Level 1 – Unadjusted quoted prices for identical assets and liabilities in active markets.

- Level 2 – Other observable inputs for the asset or liability such as quoted prices in active markets for similar assets or liabilities or quoted prices for identical assets or liabilities in markets which are not active.

- Level 3 – Unobservable inputs developed by an entity using the best information available where there is little or no market activity for the asset or liability at the measurement date.

How do you account for the impairment loss on a fixed asset?

The amount of the impairment is the difference between the carrying amount of the asset, and the recoverable amount calculated above. Basically, you want to represent the asset at its recoverable amount in the financial statements and therefore have to reduce its value down to that amount.

If the asset was previously carried at historical cost, the impairment gets expensed directly in a company’s Profit & Loss (P&L). However, if the asset was previously revalued and a revaluation surplus was recognized, the current impairment will first go against the previous revaluation surplus and any remaining amounts will be expensed in the P&L.

Also, a revaluation surplus is not seen as normal income, and therefore the revaluation surplus is an equity entry. An impairment loss against a revaluation surplus will, therefore, be entirely a Balance sheet movement and not touch the P&L, to the extent that the impairment loss equal to, or smaller, than the previously realized revaluation surplus.

For example, if an asset was purchased at $150,000 and accumulated depreciation to date is $50,000, the carrying book value is, therefore, $100,000. Now say management has determined that the asset’s recoverable amount is $80,000, an impairment loss of $20,000 has to be recorded.

The two journal entries will be as follow:

No previous revaluation surplus recognized.

| Details | Debit | Credit |

| Impairment Loss (P/L) | $20,000 | |

| Accumulate Impairment Losses (B/S) | $20,000 |

Previous revaluation surplus recognized.

| Details | Debit | Credit |

| Revaluation Surplus (Equity) | $20,000 | |

| Accumulate Impairment Losses (B/S) | $20,000 |

Reversing an impairment loss

If an assets recoverable amount has increased since the previous impairment loss was recognized (as a result of internal or external indicators), under IFRS it is allowed to reverse the previous impairment loss recognized. Under GAAP this is prohibited.

Important to remember is that the adjusted carrying amount of the asset cannot exceed the carrying amount of the asset had no previous impairment loss been recognized, so historical accumulated depreciation will have to be taken into consideration.

If we take the scenario from above and say that, due to market conditions, the recoverable amount of the asset has now increased by $20,000. The initial impairment loss went through Profit and Loss as an expense so the reversal will also go through the Profit and Loss, only now as a gain.

The journal entry will be as follow:

Previous revaluation surplus recognized.

| Details | Debit | Credit |

| Accumulate Impairment Losses (B/S) | $20,000 | |

| Increase in value of asset (P/L) | $20,000 |

The process of testing and assessing impairments on assets can be complex and time-consuming. However, it is an essential element of the financial reporting cycle of any organization, regardless if IFRS have been adopted or not.

The key to accurate impairment testing and recognition is early planning and making sure the right skills are acquired. Support from senior management is also key and they should be involved with the reviewing of selected assumptions and models and establish if they are appropriate for the particular business operations and industry it operates in.

A Simplified Look at Fixed Asset Disposal

Accounting records for a business cannot just be compiled then forgotten about. The information that these records possess are the foundation of the business that they apply to. For this reason accounting practices in general cannot just be adhered to. Detailed accounting practices are something that every business no matter what its size should practice.

What is Asset Derecognition?

On the balance sheet of every company there should be the list of assets. There will be times when this needs adjusting. One of these times is when the asset is no long contributing to the cash flow of the company. Or that asset is being transferred outside of the company which is commonly done when the asset is sold.

The sale of the asset also includes the transfer the positive and negative aspects of the asset. If this is not the case then the company must account for the asset and treat what has been received for that asset as a liability.

Year End Accounting Practice

One of the tasks that should become part of the year end closing of the company books is to review the assets to see if any fit the criteria for derecognition.

Disposal Accounting

The purpose of this accounting procedure will be to remove the fixed assets from the financial records along with the accumulated depreciation. The circumstances will dictate how the financial entries are to be made.

If there are no proceeds being recognized as a result of derecognition and the asset has been fully depreciated.

| Accounts | Debit | Credit |

| Accumulated Depreciation | $150,000 | |

| Fixed Asset | $150,000 |

The asset was bought for $150,000 had accumulated $50,000 in depreciation and was sold for $75,000.

| Accounts | Debit | Credit |

| Cash | $75,000 | |

| Accumulated Depreciation | $50,000 | |

| Loss on Asset Disposal | $25,000 | |

| Asset | $150,000 |

The asset was bought for $200,000 had accumulated $100,000 in depreciation and sold for $70,000.

| Accounts | Debit | Credit |

| Cash | $70,000 | |

| Accumulated Depreciation | $100,000 | |

| Gain on Asset Disposal | $30,000 | |

| Fixed Asset | $200,000 |

Discontinued Operations, Abandoned and Idle Assets

There are many different reasons why an asset is no longer functional. This too has to be accounted for otherwise the financials are not reflecting a clear picture of the company.

Financial sheets are used for different purposes such as;

- To provide an accounting financial picture for the tax department

- For the board of directors to have a clear understanding of the stability of the company

- To be used for investors.

For all of these reasons, the accounting has to be detailed. Which means the financials must reflect discontinued operations. This will be shown on the income statement apart from continuing operations.

There are different entries that need to be made on the financial statement to properly disclose the discontinued operations.

It has to be determined if the asset that is no longer operational is going to create a profit or loss in the accounting period. This could be as a result of the sale of the asset or the disposal of it.

The tax implications for this asset have to show on the financials, but this may be a future entry as the tax implication may be a deferred tax benefit.

The accounting entries can be in a simple format by creating a discontinued operations section. The accounting procedure that is used is going to depend on whether generally accepted accounting principles (GAAP) are used. Which this can be done but only based on two criteria.

- The transaction for the disposal must be reflected in the operations and cash flow of the asset.

- Once the transaction is completed there can be no further involvement with the asset.

Once this criterion is met then the entry on the financial statements must appear as discontinued operations.

Using International Financial Reporting Standards

If this method of accounting is going to be used then the accounting procedure is a little different. It has two prerequisites’ to it.

- Either the asset has to have been disposed of or recorded as held for sale.

- The asset must be recognized as a separate component of the business being recognized as being disposed of or it is going to be sold.

The financial entries are still made in a distinct section on the income statement, but unlike GAAP there can still be involved with the asset.

Held for Sale classification

The accounting department must be clear about assets that are being held for sale. This is not in reference to abandoned assets. There has to be some perception that an asset will be sellable. There are some specific criteria that a held for sale account must meet.

- The business must have a policy in place that will be used to determine if an asset meets the sale criteria. It has to be determined at what level of management the authority exists for the sale of an asset.

- The asset has to be ready for sale. It should not require any real effort financially or manually to get the asset ready to be sold.

- The policy should also include the format that is to be used for the selling of assets. With clear instructions as to what efforts are to be made to implement the sales efforts.

- A reasonable time frame has to be set for which the asset will remain in the held for sale account. In most cases, the time frame is either one year or within the accounting year.

- A reasonable formula has to be designed for setting the sales price has to be clearly indicated.

- For accounting purposes, an asset that is being accounted for in a held for sale account are not subject to the fair value measurements used in standard accounting practices. In this case, the metrics are the fair value with a deduction for the costs to sell the asset.

The accounting department clearly needs to know what the intentions of management are when it comes to assets that are no longer going to be used to generate cash flow. Sometimes management may envision using the asset in a modified form. If this is the case then the accounting procedure will differ.