Chapter 1

Introduction to Fixed Assets

Fixed assets are generally ticketed as the most valuable items in a company. The benefits of a proper fixed asset management solution will often spread across the various business areas of an organization.

Apart from keeping accurate records on fixed assets, it will also save money through accurate insurance premiums and tax liabilities, save time by producing easily accessible audit reports, eliminate headaches such as unnecessary purchases, and can even improve overall workplace productivity.

Before implementing a fixed asset management solution, it is important to distinguish between the various asset classes of your organization and what can, or should, in fact, be classified as a fixed asset.

What are fixed assets?

According to the International Accounting Standards Board (IASB), an asset is:

- a resource controlled by the entity as a result of past events and;

- from which future economic benefits are expected to flow to the entity.

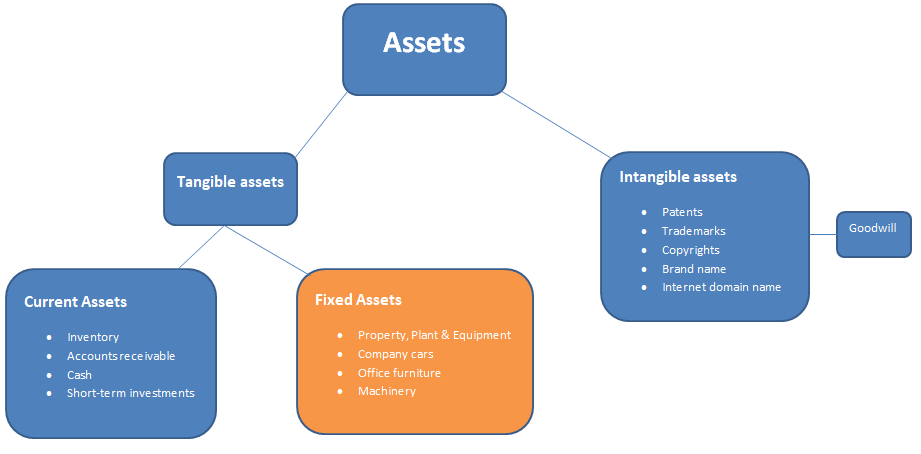

Once you’ve recognized what constitutes an asset in your organization, it can be broken down into tangible assets and intangible assets.

Tangible Assets

Tangible assets can further be broken down into fixed assets and current assets.

Fixed assets are what most people would refer to as Property, Plant and Equipment, but are also known as capital assets. The term ‘fixed’ does not necessarily mean the asset has to be fixed to something (i.e. immovable), but rather that it is fixed in the balance sheet for one year or more.

Fixed assets can be defined under two criteria:

- long-term tangible assets which are not expected to be used or converted into cash within one year and;

- assets that are held for the production and supply of goods, i.e. used in operations to generate income.

Examples of fixed assets include company cars, office furniture, equipment and machinery, land and buildings not held for sale.

Examples of current assets include inventory, accounts receivable, cash and short-term investments. These assets are considered to be highly liquid (i.e. can be easily and readily converted into cash) and are usually turned around within one year.

Intangible Assets

In simple terms, intangible assets are non-physical assets, often called intellectual assets or intellectual property. Good examples are patents, trademarks, copyrights, brand names and even internet domains.

You can’t physically touch these assets but they potentially hold huge value for a company.

Goodwill is classified as an intangible asset but is a bit of an exception to the rule and as such will often be presented in a separate line on a company’s balance sheet. The reason it’s a bit different is that if you look at other typical intangible assets, they can be separated from the company and sold independently (such as the rights to valuable patents, trademarks, etc.).

However, with Goodwill, although the value can be determined, it can’t be separated and sold apart from the company. It actually forms an important component when valuing the overall book value of a company.

Although intangible assets do not have physical substance, similar to some types of current assets, there are two distinctions to be drawn between the two asset classes.

The monetary value of current assets can be easily and quickly determined, while it’s not that simple with intangible assets. In addition, current assets are used within one year, while intangible assets will generally be held for longer.

Fixed asset classification

When an asset is purchased there are two criteria to look at which will help companies to decide whether or not the asset should be classified and recorded in the books as a fixed asset.

The first is the length of the intended useful life of the asset. If the asset will be used, sold or otherwise turned around within the next 12 months, it should not be classified as a fixed asset.

It’s important to remember here that every business is different, with different service and product offerings. As such, the exact same asset might be classified as fixed in one company, while classified as current in the company next door.

For example, if a car dealership buys a car that they intend to sell to customers, that car will be included under current assets as part of inventory.

If a fast food restaurant buys the exact same car to be used for deliveries, that car will be classified and recorded as a fixed asset under Property, Plant and Equipment.

The second criterion is the capitalization threshold of a company. For practical reasons, not every item purchased that will be used in the operations of the company with an intended useful life of more than one year, will be classified as a fixed asset.

For example, if an office buys a stapler, they won’t capitalize it as a fixed asset, although it has an intended useful life of more than 12 months and will be used in the operations of the company by office staff. The office will, however, capitalize the purchase of a computer as equipment.

Therefore, senior management will implement a capitalization limit, above which qualified expenditure will be capitalized, and below which it will simply be expensed through profit and loss.

Again, the capitalization limit will vary greatly from company to company. A local SME might have a threshold of $1,000 or below, while a big international organization could very well have a capitalization limit of $100,000 or above.

How does the treatment of fixed assets differ under GAAP vs IFRS?

The treatment of fixed assets under IFRS and GAAP can differ considerably, specifically within the following aspects:

Recognition and measurement

Under both GAAP and IFRS the initial recognition of an asset will be at the purchase price plus any cost incurred as a direct result of bringing the asset to the location and into the right condition necessary for it to be operated. This can include delivery fees and installation fees.

In the subsequent measurement, under GAAP the asset will always be carried at cost less accumulated depreciation.

Under IFRS, you will have the choice of recognizing the asset at cost, or revaluing it using a fair value (FV) model. Important to remember here is that if you do choose the FV model, all the assets in that class will have to follow the FV model. IFRS guidelines also state to only revalue an asset every 3 to 5 years as it can be time consuming and expensive.

Impairment

Under GAAP, if an asset is impaired, the impairment is expensed in a company’s Profit and Loss and cannot be reversed.

Under IFRS, the impairment can be reversed in subsequent periods if the value goes up. In addition, if the FV model is used, an impairment is first recorded against any previous upwards revaluations.

If the impairment exceeds any previous upwards revaluations, the remaining amount will be recorded in Profit and Loss.

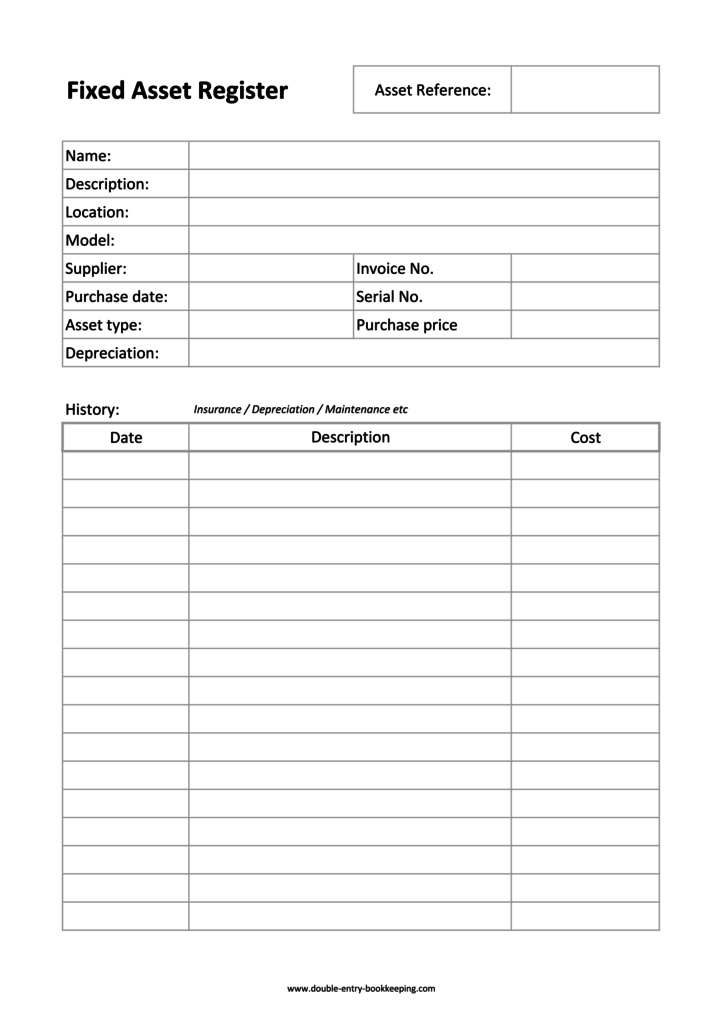

Fixed asset record keeping

Fixed assets will usually be recorded in a fixed asset register. The register will be divided into categories so that similar fixed assets are grouped together by their function or location.

It is important to keep accurate records on all fixed assets, not just from an accounting and auditing viewpoint, but also from a cost and time savings standpoint for the company itself.

Therefore, several details will be recorded for each asset, including:

- A unique asset reference number

- A short description of the asset

- Where the asset is currently located

- A Model number if applicable

- From who was it purchased (i.e. the supplier)

- The date of the purchase

- What was the original cost

- How much depreciation is charged against the asset on an annual basis

- The accumulated depreciation to date

- The date of disposal (if applicable) and profit or loss on disposal

Check an example of a typical fixed asset record card kept for each individual asset.

So before closing of this chapter, there is still a question that’s lingering? Once you’ve made a purchase, should you capitalize or expense it? i.e. is it an asset or expense? Check this video to get to know the difference:

Some organizations will keep a fixed asset register in excel. However, continually keeping the data of each and every asset of the company up to date can be extremely time-consuming, expensive and highly susceptible to human error.

Implementing specialized fixed asset management software can automate many of the processes that are normally required in a manual excel asset register and eliminate all of its accompanying pain points to not only save you time and money in the long run, but also removing the headache of retrospective error fixing which can so often accompany a messy, manual asset registry.