Chapter 2

Budget, Procure and Capitalize

No business decision for buying fixed assets should be made on a whim or merely because it is perceived that the asset is going to benefit the company. Most fixed assets come with a high price tag and can use up a substantial amount of the Company’s capital. Money that may be better spent elsewhere. However, most businesses need a variety of fixed assets to operate their business. Quite often there are choices as to which assets should be procured. This is not a decision that should be made by guesswork. Careful analysis should be conducted to create a clear picture as to when the fixed asset is going to pay for itself and what profit it is going to generate during its life span.

Fixed Assets Budgeting & Procurement

A policy has to be developed that is applied to each purchase of a fixed asset. This policy should ensure that the purchase is justifiable. It should be based on one of the accounting methods that is going to take the guesswork out of fixed asset procurement.

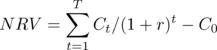

Net Present Value (NPV)

Any investment a company makes is on the premise that is going to generate a profit. This is not something that is done with a wait and see approach. Investments into fixed assets have to have a purpose and be of some value to the company. This has to be tracked. One of the methods for doing this is by using a formula for NPV.

The formula is comprised of four components which are:

- Net cash flow during the period t (Ct)

- The total initial cost of the investment (Co)

- The discount rate (r)

- The number of time periods (t)

It begins by looking at the investment period which in most cases is one year. Next, the negative cash flows are calculated for that period. Then the positive cash flows are calculated. Present value must be determined for each of these by discounting the future value using a periodic rate which is determined by the market.

The end result is the Net Present Value which gives a clear picture as to whether an investment will generate a profit or result in a loss.

A positive NPV = a profit

A negative NPV = a loss

Internal Rate of Return (IRR)

Another method that can be used for the viability of an investment. It relies on the same formula that is used for NPV. But, the big difference is that this method is not as reliable as NPV. It is something that has to be determined using complex software that is capable of performing the calculations. The outcome desired is that there will be a high internal rate of return which then makes the investment in the fixed asset more viable.

This formula could be used if several fixed assets were going to be purchased that were very similar in nature. The choice of which would be the best one would be determined by the highest IRR.

Payback Analysis

For some small business owners payback analysis is easier to understand. It shows how long a period of time it is going to take for the fixed asset to generate the cash flow to cover the cost of what was paid for that asset. In other words how long will it take for the fixed asset to pay for itself.

The method used to calculate this is based on years and fractions of years.

- Know what the cost of the fixed asset is.

- Determine how much cash flow the asset is going to generate each year

- Take the cost of the fixed asset and divide it by the cash flow. Which will equal the number of years for payback.

This is a simple method for analysis but it has some weaknesses such as;

- it doesn’t account for the useful life after the payback.

- It doesn’t take into account any additional cash flow that may occur during the asset’s life.

- Accounting for complex issues like upgrades and maintenance costs for the fixed assets.

- It doesn’t give a clear picture of the profitability of the asset.

Bottleneck Analysis

There are several things that can interfere with the profitability of a fixed asset such as; break downs, delays, excess inventory, stoppages, etc.

A fixed asset that is being used for a process has to be analyzed at each stage of the process to determine what that fixed asset’s profitability is going to be.

A time analysis has to be thoroughly completed for each stage of the process has to be performed. It requires expert and accurate estimates of what the potential peak flow is, then what can interfere with each of the processes and what impact it will have.

Leasing vs. Buying a Needed Asset

This is a decision that should not be made without knowing all the facts first. There are several factors that have to be considered. There are pros and cons to both options for acquiring an asset.

Pros of Leasing Fixed Assets

Cons of Leasing Fixed Assets

If the asset is a piece of equipment that is going to constantly have new technology applied to it, then the preference should be to lease it. This way the business can remain on par with its competition.

Money is not always available to buy new assets. Often it may mean having to finance them. This escalates the cost of the item.

Investments into high-cost asset ties up capital of the company. This is money that may be better used elsewhere.

There are tax benefits to leasing as quite often the lease expense can be charged as an operating expense.

With many leased items there are no maintenance costs although this can vary.

- The cost for the asset, in the end, will usually be higher.

- There is no equity being built with the asset.

- The lease terms may exceed the usefulness of the asset.

- Maintenance provided by the leasing company may be limited.

- Choices in assets to lease may be limited.

Pros of Buying Fixed Assets

Cons of Buying Fixed Assets

- Ownership is the company’s.

- There is an option to sell the asset.

- There is the depreciation deduction.

- There are no leasehold controls on the asset.

- The layout of the capital will be greater.

- The asset can become outdated before its end of life.

- The maintenance responsibilities lie with the company.

- Buying fixed assets require careful thought that should lead to the implementation of a policy and procedure format.

Fixed Assets Capitalization

The accounting department of every business has to be sure they are following the proper accounting procedures. A lot of the success of the company depends on this. Often small businesses make the mistake of thinking that the accounting is only important as it pertains to tracking income and expenses and to meet the requirements of the tax laws. But, accounting procedures can provide critical information as to the financial strengths and weaknesses of a company.

What is Capitalization?

This is when a cost to a company is recorded as an asset and not as an expense.

What is Capitalized Interest?

Often funds are used in the construction of a long term asset. In the majority of cases the money is borrowed for the construction funding. A loan will come with interest costs. This is an added cost that has to be accounted for. It has to be applied to the long term asset. The most common accounting procedure used for this is accrual basis accounting.

Example of Capitalizing an Asset Interest

A new business is going to build their own corporate office. They need one million dollars in funds to do this so they ae going to obtain a construction loan. The lender of the money will charge 7% interest on the loan. This now becomes part of the cost of the asset which is going to become a long-term asset.

Developing a Capitalization Policy

For larger Corporations, it is always advisable to have a capitalization policy. It is because it is not unusual for there to be a staff turnover in the accounting department. Quite often there are accounting options that can be used. If a capitalization policy is in place it helps to maintain consistency in the accounting practices.

With capitalization accounting depending on which accounting procedure is used it is either going to affect the balance sheet or the income statement during a specific accounting period.

Have a clear definition as to what the fixed assets of the company are going to be or are, sets the foundation for the capitalization policy.

Accrual Basis Accounting

This is the form of accounting that is used to record the transaction of a business as they occur. For example, the financial entries are made when the revenue is generated and when the expenses occur.

The Financial Entry

A portion of the interest will be paid each time a payment is made on the loan. This has to be accounted for, but it will not be accounted for as an interest expense. Being as it is part of the expense of the long-term asset. It has to be included as part of the expense of the fixed asset which will be included in the depreciation of the asset.

On the financial statements, it will originally appear on the balance sheet. During the period of the useful life of the asset, it appears on the income statement as a depreciation expense.

Interest Capitalization Periods and Rates

This type of accounting procedure can get complicated and is usually reserved for situations where there is going to be a substantial interest expense. It can also give a false impression of the real cash flow of the company because the interest expense is being deferred.

Determining the Capitalization Rates

The borrowing cost has to be determined which is going to be applicable to the fixed asset. There are two basic ways this can be done:

1. Borrowing Cost with Direct Attribution

- It has to be determined if the money borrowed was specifically for the purpose of the asset.

- If so then the borrowing cost should be known as per the rate of interest.

- If any investment income is earned on these borrowed funds this has to be deduced from the borrowing cost.

2. General Fund Borrowing

Sometimes Corporations have other Company sources to borrow from. These could be a general line of credit that is used for many different things.

If the funds for the asset are borrowed from the general fund then calculations have to be made to determine the borrowing cost for the specific amount of money being borrowed based on the borrowing cost of the general fund.

It will be based on a weighted average. There will be a limit that can be used as the borrowing cost which is determined by the period of time in which it is used for the asset.

When Does Capitalization of Borrowing Costs Cease?

Capitalization of the borrowing costs does not continue for the entire life of the asset.

These borrowing costs are applicable to the construction of the asset. Therefore when the construction is completed then the capitalization of the borrowing costs has to cease.

Capitalized Assets vs. Uncapitalized Assets

It is important the accounting department clearly understand what can be capitalized and what cannot be capitalized regarding assets. This can get confusing when a company is going to construct a building which in itself will become a fixed asset.

If a building is purchased, what can be capitalized?

If a building is built, what can be capitalized?

- The original cost of the building.

- Any updates or improvements made to the building to make it more useable.

- Any upgrades or repairs that were deemed necessary to make the building compliant.

- Professional fees for the acquisition of the building.

- Accrued or unpaid taxes that were owed on the closing day of the purchase.

- Existing lease costs such as buy outs or cancellations.

- Any costs that were generated in order to render the building useable for the intended use.

- The costs incurred to construct the building.

- Any interest accrued during the building construction.

- Preparation of the land for the building construction.

- Planning costs for the building including professional fees.

- The use of any temporary buildings required during the building phase.

- Any construction costs that were not planned for.

Once the concept of the accounting practices for capitalization are understood it makes the accounting process much easier.